Increasing the ROI of Your Brand Tracker

I can sum up my philosophy about brand trackers in a simple thought — done well, they should be a treasure trove of insights and never a flat, stale report.

Having spent many years managing brand tracking studies on both the client and vendor side, I can unequivocally say they are simultaneously the most customary yet most underleveraged studies. Sure, marketers may value being able to cherry-pick stats that shine in front of senior leadership but are likely not getting a strong return on their investment beyond that. From a vendor perspective, I’ve often heard brand tracking studies called “cash cows” because they generate consistent streams of revenue while operating on autopilot.

What I have also experienced firsthand is that tracking studies can be downright mundane, whether you are the deliverer or recipient. That is, unless you enjoy the ritualistic updating of stale PowerPoint templates, mind-numbingly stagnant trends and over prescription of statistical testing. If you have a desire for something more dynamic from your tracker, here are some thoughts on how to improve the ROI of your tracker.

A Brand Tracking Study Is Not A Measurement Tool, It’S A Strategy Tool

I’d be lying if I said that it isn’t ALSO a measurement tool, given that it needs to be designed in a way that provides a stable view of how the brand is performing, but let me explain. While you may associate brand trackers with an encyclopedia’s worth of KPIs and time-series trends, the scale and content of the data behind these trends is actually an abundant source of insight for your brand. That’s why when a client asks what they should field, my first response is always to ask, “When does your strategic planning cycle take place?” That’s also why, at Trajectory, we are not just a team of researchers, rather, we are a cross-discipline organization inclusive of researchers, strategists, data scientists and SMEs across the spectrum of marketing from creative and media to experiential and digital experience.

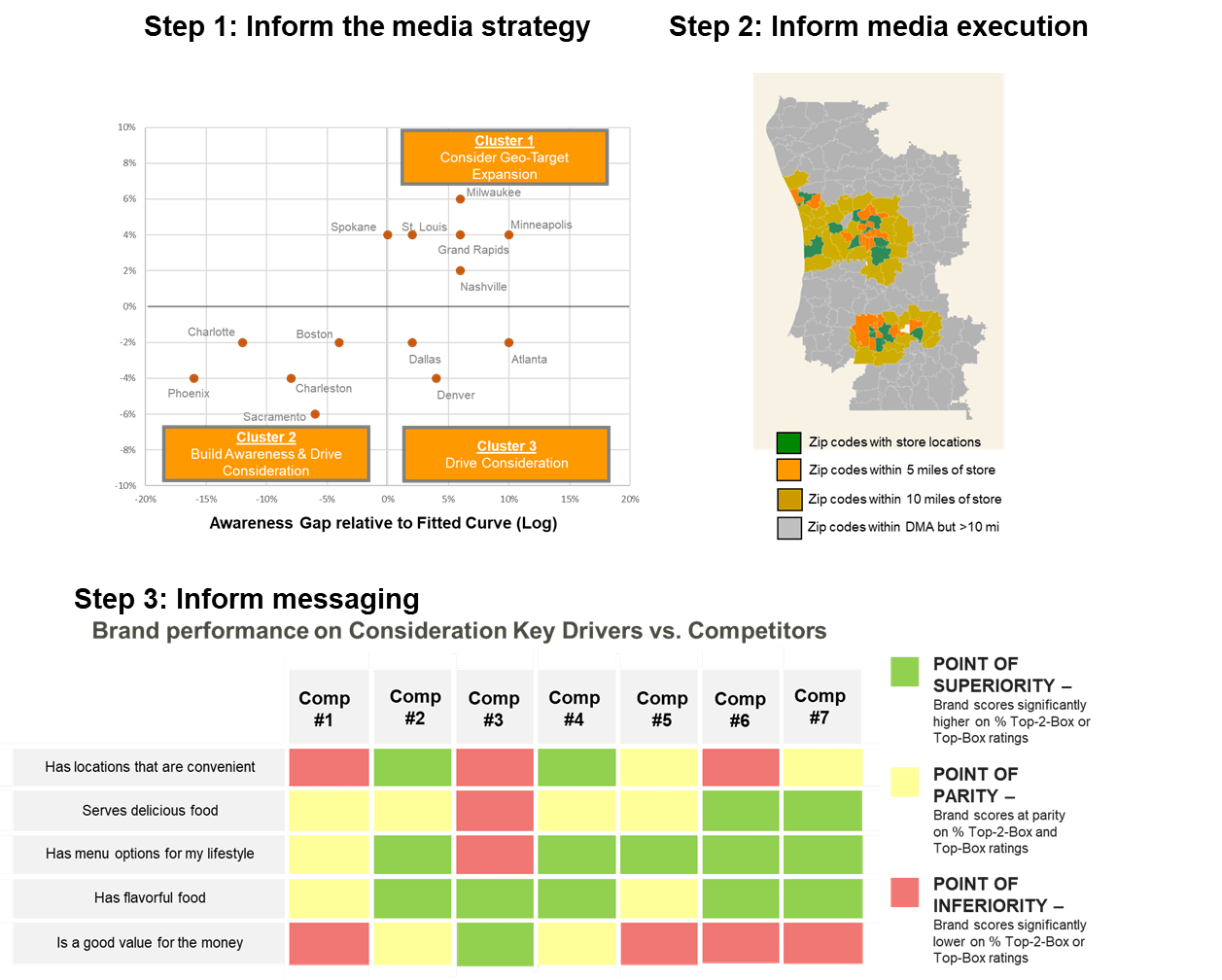

Now, you’re probably thinking, “that sounds neat, but could I have a little more detail on how you make a tracker more strategic?” One way we go about that is to take that flat, static brand funnel and actually do something with it. Take for example our work with a fast casual dining client. Rather than just reporting the funnel measures like awareness and consideration, we put them to use in helping drive the brand’s media strategy. We did this in three steps:

Step 1: Inform the media strategy by market. We tracked the brand’s strength in over a dozen DMAs and were able to use our measures of Awareness and Consideration combined with a third ingredient, the share of population living near a store, to identify where the funnel opportunity was by market. Some markets were underdeveloped on Awareness, others on Consideration. Ultimately, we ended up with three clusters of markets, each with its own designated media strategy.

Step 2: Inform media execution by market. This required some additional data wrangling beyond what we captured in our survey, along with some geo-mapping analysis. By looking at the distribution of stores relative to the population, we drove to a market-by-market recommendation on how far out to go with media geo-fencing. In some cases, we stuck closer in at a 5-mile radius while for others we saw opportunity to push out to 10 miles.

Step 3: Inform messaging that will drive the intended outcome. Key drivers analysis is a common tool when conducting a brand tracking study. Typically, it comes down to some measure of satisfaction or loyalty as your dependent or “outcome” variable. However, it is ill-advised to think so myopically about outcomes. In this case, we knew there were markets where we wanted to move Consideration, so that became the outcome variable we wanted to drive. The output of this exercise yielded five highly significant drivers of consideration. We then layered in the client brand’s performance on these drivers vis-à-vis competitors which led us to hone-in on the brand’s key point of distinctiveness to message against: “a uniquely bold flavor experience.”

“Brand” Is Not A Synonym For “Marketing”

Brand Tracking studies are most commonly commissioned by brand marketers with responsibilities for things like marketing strategy, campaign development and media placement. You’d be surprised (or maybe you wouldn’t) to hear how often we are invited in to do a brand tracking study to only work with the team directly responsible for these narrowly defined marketing duties. There is an entire organization of not just marketers but countless other brand stakeholders who should be exposed to insights that they could actually use to drive sales and build the brand.

If you want to get the most out of your tracker, then take a more inclusive view of who you engage in the process. Anyone and everyone who plays a role in bringing your brand to life should be in the loop — from how the brand looks and speaks to where it is distributed and how it is experienced. For instance, we had a tire manufacturing client with whom we had been running a tracker for years. Early on, it was just us and the lone marketer that owned the project who reviewed the report. As time went on, we established our credibility through the quality of our output (and equally important, our input), and eventually our audience began to include multiple other disciplines, as well as all of the client’s advertising & media agencies.

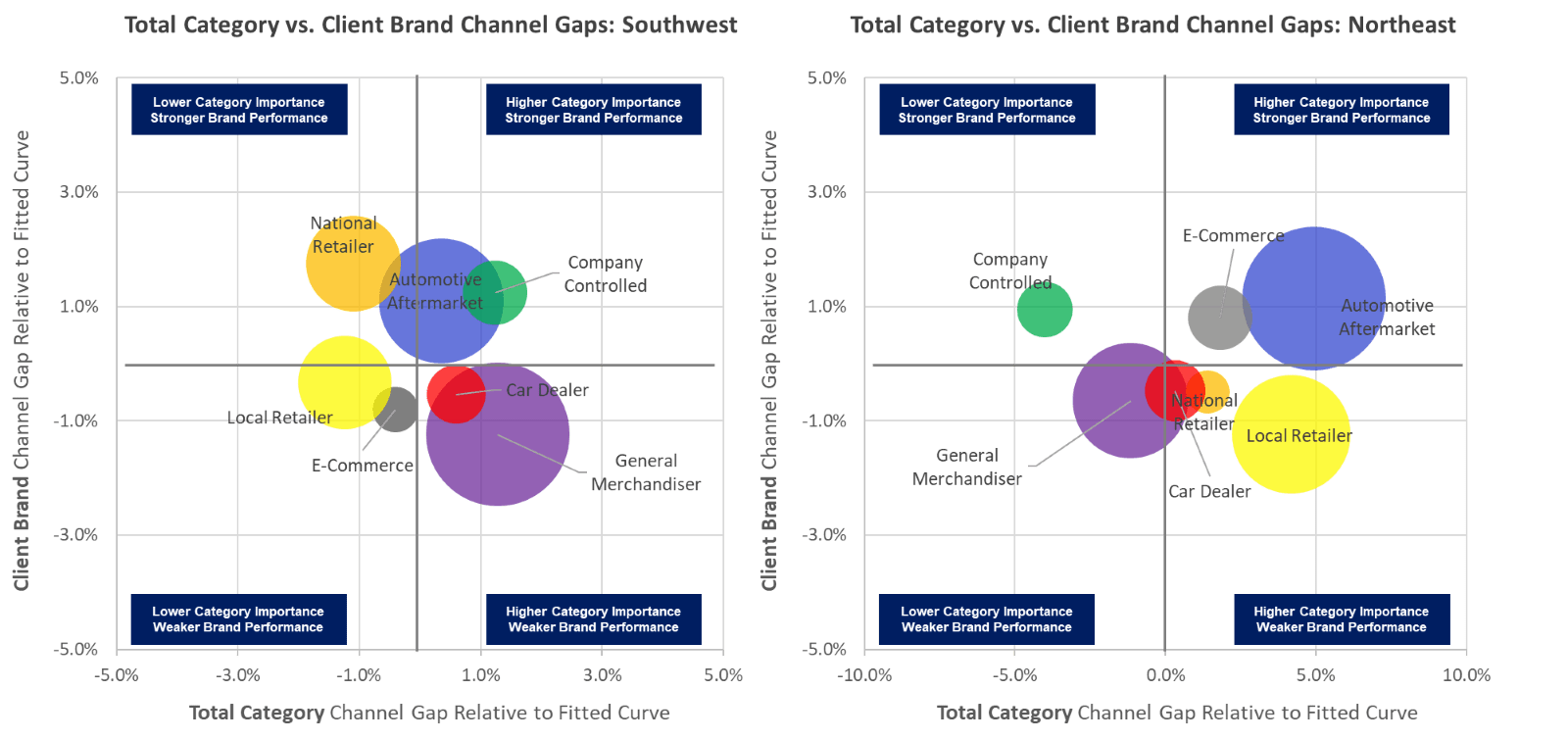

One of our newly engaged stakeholders was the head of Channel Operations. We had been asking purchase channel questions in our tracker since its start, but hadn’t really done much beyond reporting trends. That is, until we knew we had an opportunity to do something actionable with it. In partnership with our new stakeholder, we created an analysis which looked at channel development relative to expectations by market and juxtaposed the brand’s performance to identify channel growth opportunities. The chart below shows a snippet of the output for two of the markets.

Some of our insights, like the opportunity to grow the brand in General Merchandisers in the Southwest, were things already on Channel Ops’ radar. This was meaningful validation for both of us. Some of our insights were new findings, such as the need for a more concerted Local Retailer strategy in the Northeast.

Keep It Fresh

Once trackers are turned on, they are difficult to discontinue because you risk “losing the trends.” Indeed, the most common reasons that I have seen for ending tracking studies typically have to do with M&A activity. I’ve seen brand trackers survive even the most draconian marketing budget cuts.

In order to ensure a strong ROI from your tracker, and not bore your peers to death, it is vital to be able to turn out new insights and keep your stakeholders engaged with the content of the tracker. We have many prescriptions for keeping it fresh, including things like flexing new questions and doing topical deep-dives at each report out. You can also extend your tracker by including other methodologies like qualitative interviews and social listening analysis. But perhaps the best way to stay relevant is to keep the data trends themselves fresh and front-and-center through use of a marketing intelligence dashboard. Some of the most successful examples I’ve seen have included the following criteria:

- They are rooted in a vision defined by the brand. If you don’t have a vision for how it will be used and by whom, then don’t do it. We had one client that used it merely as a quarterly scorecard — we did away with it. On the other hand, we have a client that took the time and their internal capital to socialize the new dashboard. While they themselves are the power user, everyone at the organization knows timely trends to their most pressing questions are available on-demand.

- They are merged with other marketing intelligence dashboards. Having a single source of truth should be your North Star. This means bringing together disparate data streams into a centralized place where you can make sense of it all. At minimum, we’d recommend including brand tracking metrics with marketing & media performance. If you can layer in sales data, all the better.

- They are fully self-service and dynamic. To be fully self-service, a dashboard needs to be intuitive and comprehensive. On our end, we can tell if we are successful by the number of inquiries we get for data pulls — if that frequency goes down, we’ve accomplished our task. That means the client should be able to slice and dice the data any way their heart desires. On a recent dashboard build we incorporated over 100 custom filters — imagine all the possibilities.

- They are as real-time as possible. If you already get together on a quarterly basis to review trends, then quarterly dashboards make little sense. Updating trends on a weekly basis, with as little lag as possible, is like the ideal state. One technical caveat, however, is that your data collection must be demographically and geographically balanced on a weekly basis for this to work.

Demand Excellence From Your Partners

If you have a tracking vendor that is allowing you to reap the full value of the large sums you spend on tracking, I say embrace them and treat them like the valued business partner they desire to be. But, if having read this, you feel you could be getting more from your tracker, check out our work or shoot us a note and we’d be happy to discuss how we can help you improve the ROI of your brand tracker.